Properties Change

Agents Don’t

We build indexes to show the value that an agent brings to a sale, property by property, street by street, worldwide.

See BestAgent

Registered supplier

BestAgent™ ARCH

Arrears Recovery Collections Hardship

Anayltical Agent

Optimal agent selection via hedonic and quantitative dynamic tools. Analytics based on:

- Peer to peer agent indexing.

- Agent versus market analysis.

- Full agent transaction history in first column.

Geospatial & Geospecific Recognition

Contextualised results with predictive and prescriptive attributes.

- Improved forecasting.

- Numerous API Data sets used for reliabilty and accuracy.

- Region, suburb, street or property breakdown.

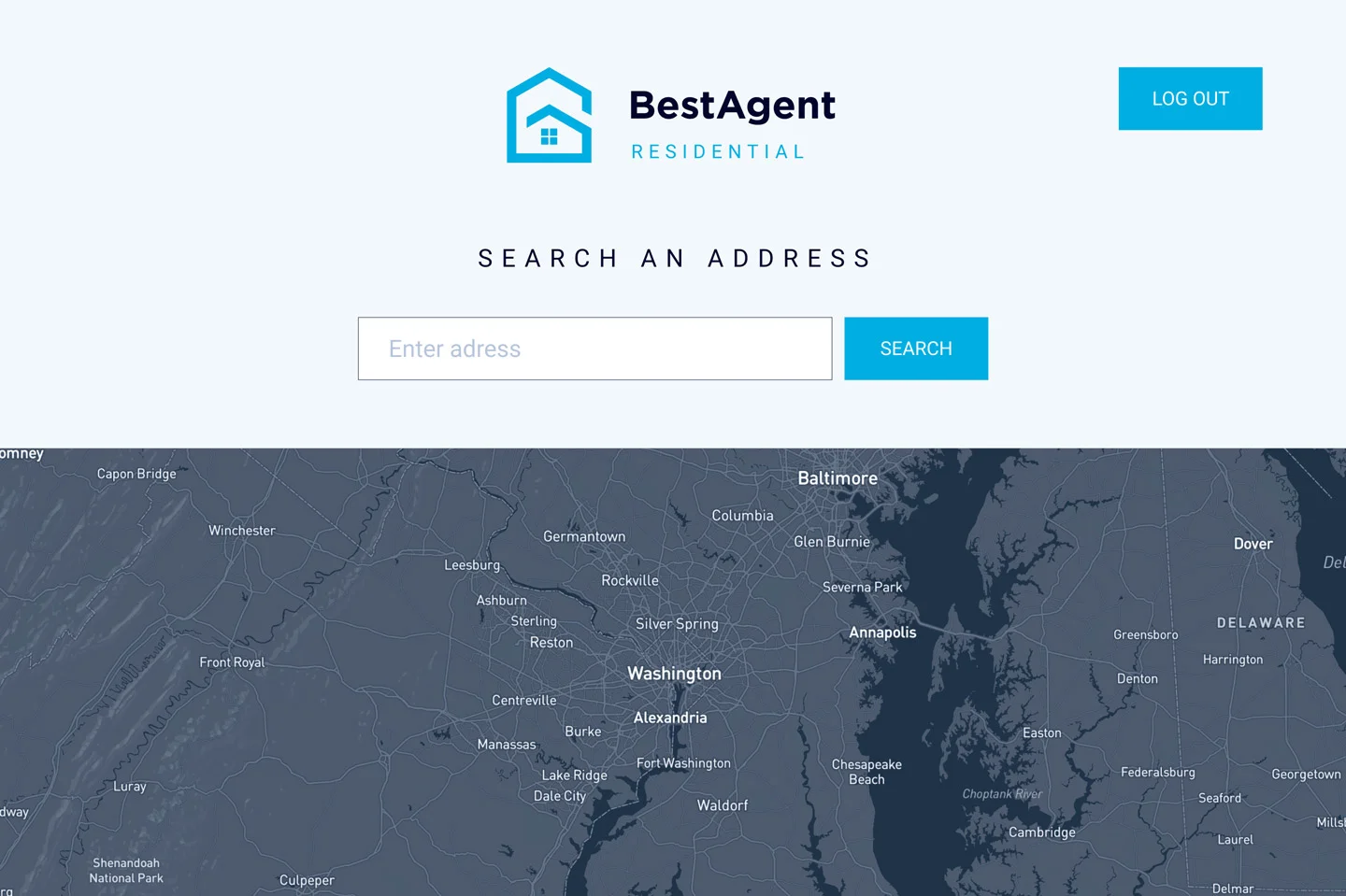

Intuitive User Interface

- User friendly, graphical interface.

- Training sessions and easy onboarding process with instructional video sessions & IT support.

BestAgent™ Calculator

Feeling confident about your finances comes with having the right support on your side.

When it comes time to sell the family home or an investment property, there’s a lot to consider when selecting whom to sell with...it can be one of the most challenging and stressful parts of the homeownership life cycle.

We’ve built an agent calculator that develops a localized index of selling agents using their transaction econometrics to quantify who’d be the BestAgentTM to sell the family home or investment property, by their numbers.

BestAgent™ Calculator Advantage

Helping your customers realize a higher market value, faster, when selecting whom to sell property with.

Traditional Available Agent Econometric Averages, by Postal Code or Suburb

- Sale Price

- Number Sold

- Number for Sale

- Star Ratings

The BestAgent™ Calculator Available Market + Agent Econometric Averages, Geo-Spatially by Property Type + Address

- Sale Price

- Sale Price per Square Foot

- Number Sold

- Days on Market

- Listed to Withdrawn Ratio

- List Price to Closing Price Differential

BestAgent™ Alexa

Ambient Computing is the future

Mark Cuban: Voice, Ambient Computing are the Future and Why Developers Should Get in Now

Alexa BestAgent Prime Real Estate

Who We Serve

-

Innovation Hubs & Labs

BestAgent lessens loss given default by quantifying a qualitative analogue process, ensuring more for those with less facing residential foreclosure.

Hosting our BestAgent platform, to allow access for the testing and auditing of your retail banks legacy processes, procedures and outcomes around residential real estate foreclosures.

-

Preventative Default Loss Mitigation

Stay ahead of foreclosures with easy to initiate, data driven discussions to collaborate with mortgagor on who to sell with to optimise price and timing.

-

Collections & Recovery

Lessen loss given default during liquidation. Eliminate liquidator selection bias. Shortened processing timelines.

-

CRE35 Basel III & Basel IV compliance

Increase your banks minimum regulatory capital reserves by lessening unexpected loss given default during residential real estate negating capital reallocation.

-

API Commercialisation

API data feeds are a substantial capital expense. There is an opportunity to commercialise the feeds utilising the BestAgent platform , to provide superior analytical insights into local housing markets as a performance benefit to staff and a value add to clients.

-

Asset Management Tool

Quantitatively optimising purchase and sale cycles by indexing market participants econometrics who transact above and below their markets average sale results based on a property’s geospecific, hedonic and chronological attributes.

-

Asset Management Tool

Quantitatively ensuring the value of the underlaying securitised asset during a mortgage default event by indexing liquidators econometrics based on a property’s geospecific, hedonic and chronological attributes before reintroducing the asset into the rim/tranches without loss of value.

Enabling ESG best practices & collaborations

Stay ahead of residential real estate foreclosure with easy to initiate, data driven discussions for those customers who need it the most.

Mission

To ensure more for those who don't want to settle for less when selling real estate.

Jim

Fran

Manny

Diversity without boundaries = limitless possibilities

We have a stake in one another...what binds us together is greater than what drives us apart